By J.P. Dahdah, Founder & CEO of Vantage

IRA investment trends show that there is an overwhelming use of alternative investments to improve portfolio diversification. According to the Security and Exchange Commission, 2012 Self-Directed IRA funds surged to more than $100 billion.

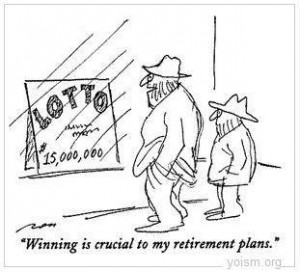

Have you been frustrated with the pennies-on-the-dollar investment opportunities that exist in today’s market? Did your retirement fund take a hit in light of the recent financial collapse, and now you’re trying to find investment strategies to make up for the loss?

In increasing numbers, savvy investors are finding ways to control their investment dollars and discovering higher-yielding investment opportunities. Maybe it’s time to look at recent IRA investment trends and strategies and what is driving those trends.

Self-Directed IRAs are the fastest growing segment of the IRA market and are projected to grow at a rate of over $200 billion per year in the near future. Here is where all that money is going:

Real estate represents the largest percentage of alternative investment dollars. This trend seems to be a win-win for both the Self-Directed IRA (SDIRA) investor and real estate investors seeking capital. Real estate is the favorite investment choice for those participating in a Self-Directed IRA, and Self-Directed IRAs have become a favorite of real estate investors. Real estate investments outside of the United States are also experiencing a surge.

Precious metals have been trending rapidly, as well. Since the collapse of the stock market, more and more money is pouring into precious metals as an alternative to a stock-heavy portfolio.

Other IRA investment trends that have seen significant investment growth include tax liens and private company investing. Both allow equity investments with tax-protected profits.

What is driving these IRA investment trends?

- An aging baby boomer population that lost a significant portion of their retirement money over the course of recent financial disasters

- Numerous investment scandals that have led to a lack of trust in traditional financial institutions

- An unpredictable global market that seems fraught with looming defaults and financial woes

- Dissatisfaction with Congress’s inability to avert permanent threats to the U.S. economy like the sequester and government operating funding

- Dissatisfaction with mutual funds managers

If any of these drivers describes you, then you may want to join the growing number of Self-Directed IRA investors who are controlling their investment options and finding vehicles that provide an opportunity for real retirement fund growth.

What is your retirement investment strategy?

For more information on how you can discover your IRA investing alternatives, contact our team at (866) 459-4590 or ClientService@VantageIRAs.com.