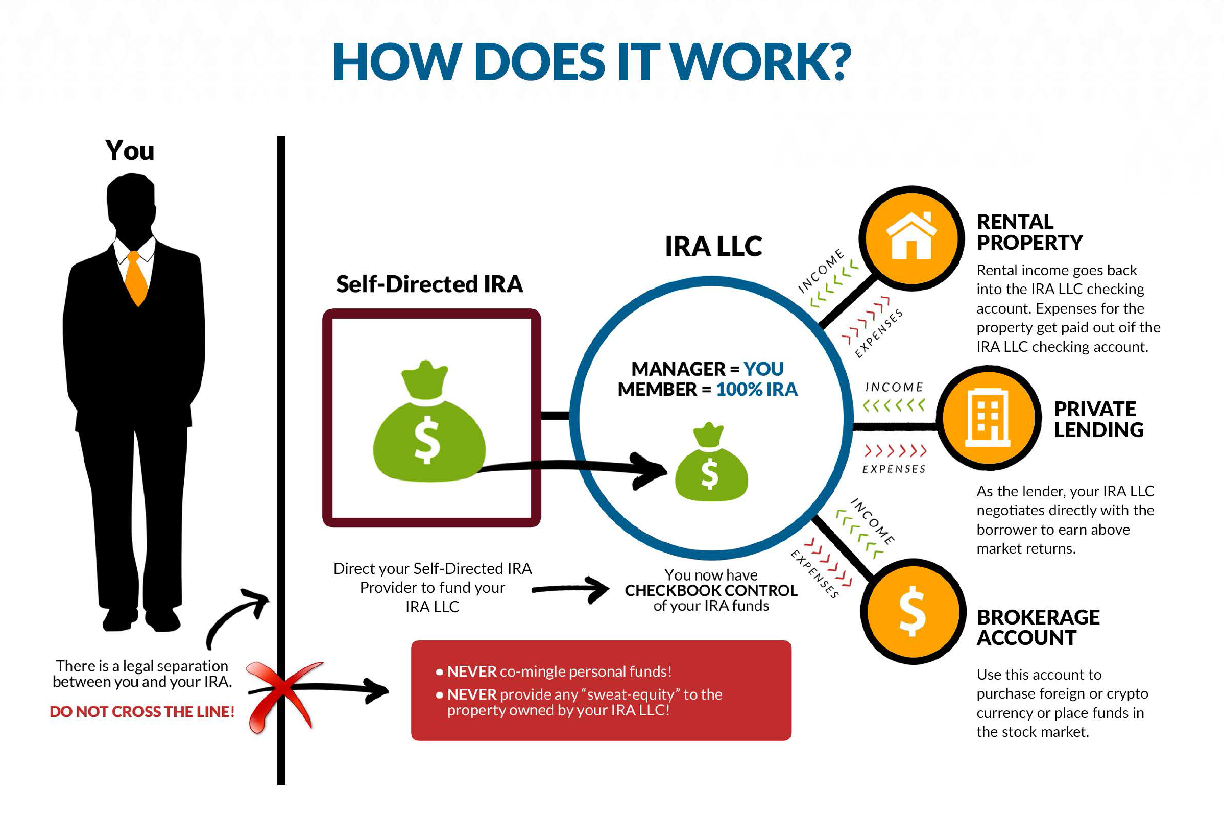

Establish a Vantage Self-Directed IRA.

Checkbook IRA LLC

Take Ultimate Control Of Your IRA Money With A Checkbook IRA LLC

The Checkbook IRA LLC structure is similar to the one you may already be familiar with when using a traditional Limited Liability Company (LLC) as an investment holding company.

The main difference is the ownership structure. The 100% member of a Checkbook IRA LLC is your Vantage Self-Directed IRA, instead of you as an individual, yet you maintain the same tax-advantaged investment environment your IRA enjoys.

Additionally, the Checkbook IRA LLC is limited as to whom it can and cannot conduct business with based on the IRA rules.

BENEFITS OF A CHECKBOOK IRA LLC

- Could reduce the IRA fees you pay.

- Can increase the timeliness of investment transactions and offer you more control over your assets.

- Allows you to co-invest with others and pool money to make larger or multiple purchases for increased diversification.

- Provides additional asset protection which helps add a layer of safety against creditors and litigious adversaries.